Queen’s has at least 11 alumni above the senior vice-president level at eight of Canada’s 10 largest fossil fuel companies, a Journal inquiry has found.

A broad survey of the University’s investments, donations and corporate-backed research shows deep ties to Canada’s oil and gas sector. Across its three largest portfolios, Queen’s invests nearly $78 million in Canada’s 10 largest fossil fuel companies, making up more than a third of the university’s total oil and gas investments. Queen’s has also taken in high-dollar donations from the country’s largest polluters.

Here are Queen’s connections to 10 of Canada’s largest oil and gas companies:

Imperial Oil

Total investments: $491,085.95

Donations: $1,000,000 – $4,999,999

Research contributions: $498,000

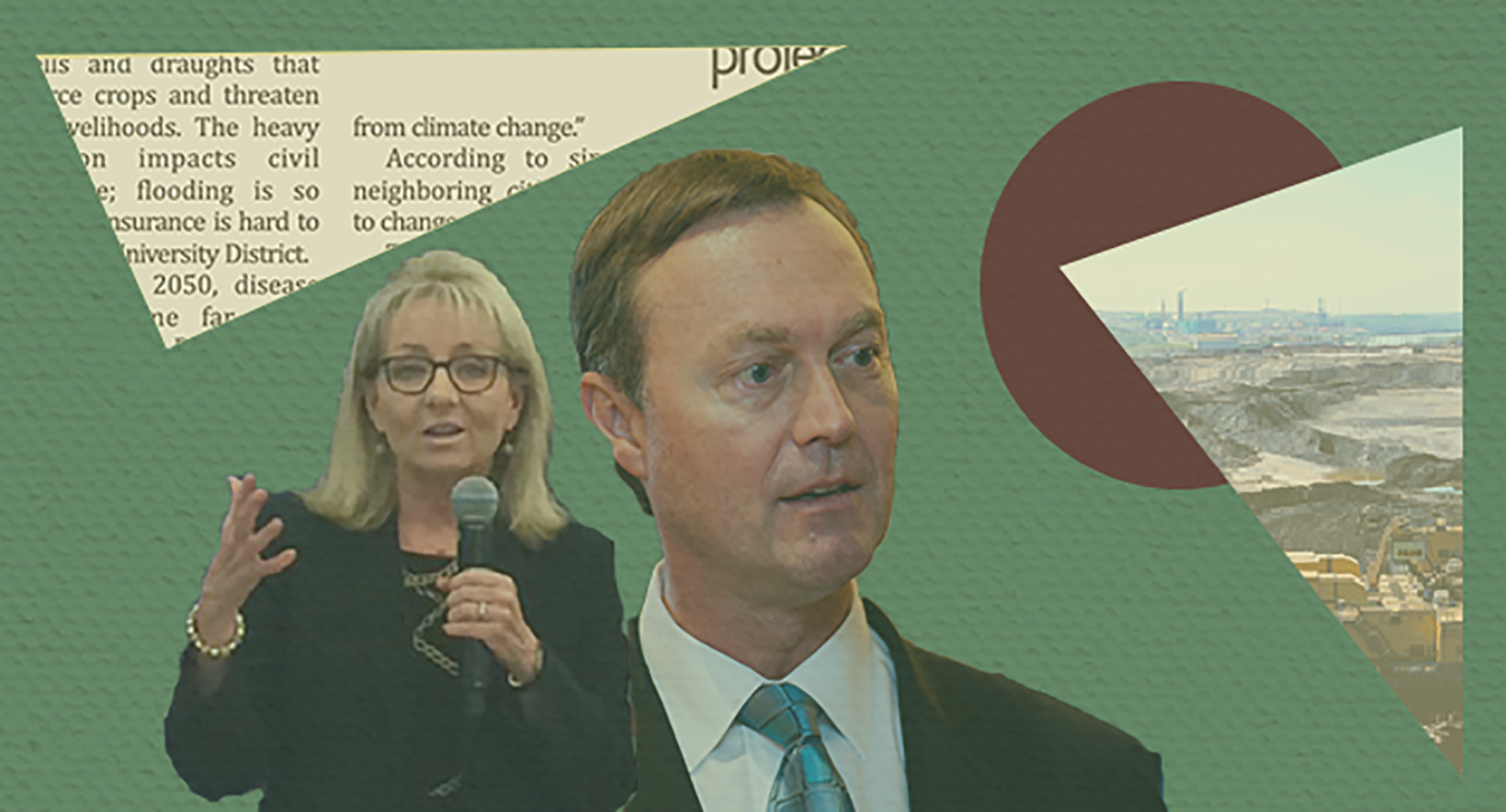

Alumnus: Theresa Redburn, senior vice-president, commercial and corporate development

The company contributes more to research at Queen’s than Canada’s ten largest fossil fuel companies combined. It also holds the top spot for donations. Redburn, who has a Bachelor of Science degree from Queen’s, takes home the second-largest salary at Imperial, according to the company’s disclosures. In May 2018, along with Rich Kruger, Imperial’s CEO, Redburn met with Paul Rochon, deputy finance minister, to personally lobby against the government’s clean fuel standard (CFS)—an initiative that would require producers of fossil fuels to cut greenhouse gas (GHG) emissions associated with making their products. According to CBC, the company is now researching ways to reduce those emissions. The Journal confirmed last week some of that research is currently happening at Queen’s. The company funds a $96,000 project aimed at minimizing emissions associated with producing and refining oil.

Suncor Energy

Total investments: $10,322,333.42

Donations: $500,000 – $999,999

Alumni: Mike McSween, executive vice-president, upstream; Paul Gardner, senior vice-president, human resources; Mike Agnew, vice-president, mining

Suncor is Canada’s second-largest producer of oil. In 2017, the company was responsible for releasing more than 17 million tonnes of greenhouse gases into the atmosphere, according to Environment Canada. It operates primarily in Alberta’s oil sands and focuses on domestic oil production and export markets, including the US and Mexico. Queen’s doesn’t have active research funded by the company, but holds a more than $10 million stake in Suncor through various investments. The University has also taken in more than half a million dollars in donations from the company. McSween, who holds a Master of Business Administration from Queen’s, leads the company’s oil sands portfolio and all of worldwide production and exploration. In September 2018, Suncor, along with Teck Resources, which is also on this list, opened the Fort Hills oil sands expansion, which currently produces nearly 200,000 barrels of oil per day.

Teck Resources

Total investments: $2,736,082

Donations: $100,000 – $500,000

Alumni: Donald R. Lindsay, president and CEO; M. Colin Joudrie, vice-president, business development

Teck Resources, a Vancouver-based diversified mining company, has recently proposed the largest-ever expansion to Alberta’s oil sands. The proposed $20-billion, 260,000-barrel-per-day Frontier Project, found its way to Environment and Climate Change Minister, Catherine McKenna’s desk for approval this summer. The company, led by Queen’s alum Donald Lindsay, is pushing for the project’s approval despite its proposed location just 30 kilometres from Wood Bison National Park, one of the world’s largest protected wildlife reserves and a UNESCO world heritage site. In a statement to The Journal, Queen’s said it’s “proud” to count Lindsay as one of its distinguished alumni. Both Teck and Lindsay are high-dollar donors to the University. If the project is completed, it will increase Alberta’s oil sands capacity enough that Canada will fail to meet its Paris Accord targets.

Enbridge

Total investments: $25,531,927.01

Donations: $100,000 – $500,000

Alumni: Vern Yu, president and chief operating officer, Liquids Pipelines; Matthew Akman, senior vice-president, strategy and power; Michele Harradence, senior

vice-president and chief operations officer, gas transmission and midstream.

Enbridge operates the world’s largest transport network of crude oil. It controls a series of pipelines that span 27,564 kilometers across Canada and the United States. The company is responsible for transporting 25 per cent of crude oil in North America, and delivers more than 3 million barrels of liquids and crude oils daily. In February, Enbridge sponsored a speaking series at Queen’s promoting the oil and gas industry, where Harradence, a senior VP at the company who holds a mechanical engineering degree from Queen’s, spoke to students. The company has also donated between $100,000 and $500,000 to the University. Currently, Enbridge is planning to install pipelines in Ottawa, Simcoe County, the Durham region, and Liberty Village.

TransCanada

Total investments: $21,734,763.47

Donations: $100,000 – $500,000

Alumnus: D. Michael G. Stewart, chair, governance committee

The company owns and operates liquid pipeline infrastructure that stretches more than 4,900 kilometres through both Canada and the United States. The Keystone Pipeline system, the company’s largest and most contentious pipeline, is responsible for moving 20 per cent of Alberta’s crude oil to refineries in Texas, Oklahoma, and the US Gulf Coast. While the University doesn’t have active research backed by the company, TransCanada has donated between $100,000 and $500,000 to Queen’s. Stewart, a member of the company’s board of directors, holds a Bachelor of Science degree in Geological Science from the university, and has held several senior executive positions with companies including Westcoast Energy and Orleans Energy Ltd. Currently, the company plans to install a 200-kilometre pipeline in Edmonton, Alberta, with the capacity to transport more than 900,000 barrels of oil each day.

Husky Energy

Total investments: $2,060,128.89

Donations: < $100,000

Research contributions: $15,000

Alumnus: Janet Annesley, senior vice-president, corporate affairs and human resources

Husky manages pipelines primarily in Western and Atlantic Canada, although they also have operations in the United States and the Asia Pacific region. Their largest series of pipelines spans more than 1,900 kilometres through both Alberta and Saskatchewan. The company also has a 4.1 million barrel storage capacity in Hardisty, Alberta. While Husky hasn’t met the $100,000 minimum donation threshold to earn themselves a place on Stauffer Library’s Benefactor Wall, Queen’s has an active research contract with the company worth $15,000 to study the impact of hydrocarbon migration, which occurs when petroleum exits source rocks during drilling. Annesley, a senior VP at Husky, holds a Master of Business Administration from Queen’s, and also serves on the board of the Canadian Chamber of Commerce. Husky owns and operates asphalt refineries, like the Husky Lloydminster Refinery, and ethanol plants, which are scattered across Saskatchewan and Alberta and produce 260 million litres of ethanol annually.

Canadian Natural Resources Ltd.

Total investments: $9,584,770.95

Donations: < $100,000

The company is the largest independent natural gas producer in Canada, as well as the largest heavy crude oil producer. Its operations in natural gas are predominantly in northwest British Columbia and northwest Alberta, while their crude oil production takes place in both Alberta’s oil sands and overseas in countries like Côte d’Ivoire. While the company doesn’t currently have active research with the University and hasn’t donated more than $100,000 to the University, Queen’s invests nearly $10 million in the company. Canadian Natural Resources also owns and operates several oil sands mining assets in Fort McMurray and Edmonton. In anticipation of the federal government’s Clean Fuel Standard, the company is currently exploring technology to reduce greenhouse gas emissions associated with mining and resource extraction.

Cenovus Energy

Total investments: $3,194,898.05

Donations: < $100,000

Alumni: Drew Zieglgansberger, executive vice-president, upstream

Cenovus is an oil and natural gas company headquartered in Calgary. The company produces oil and natural gas in British Columbia and Alberta, but specializes in oil sands extraction in northern Alberta. Cenovus has been drilling in Alberta’s oil sands for more than two decades, and has oil-producing operations in both Christina Lake and Foster Creek. The company also has assets in the Deep basin, a natural gas fairway in northwestern Alberta. Cenovus produces 120,000 barrels of oil per day from these assets. Zieglgansberger, who holds an advanced executive certificate from Queen’s, is responsible for the safe operations and future development of both the company’s oil sands assets and its Deep Basin operations. The company plans to expand their oil sands assets by opening two more drilling locations in Narrows Lake and Telephone Lake, both located in northern Alberta. The University currently holds a more-than-$3-million stake in the company through various investments.

EnCana

Total investments: $2,206,184.78

Donations: < $100,000

Alumni: Corey Code, executive vice-president and chief financial officer; Michael McAllister, executive

vice-president and chief operating officer

Encana is a North America-based energy company that specializes in the production of oil, natural gas, and natural gas liquids. The company operates primarily in three resource-rich locations: the Permian oil basin in Western Texas, the Andarko basin in Oklahoma, and the Montney basin, which spans northwestern Alberta and northeastern British Columbia. In 2018, the company produced an average of 1.158 billion cubic feet of natural gas and 78.2 thousand barrels of oil per day from its assets. Code, who holds a Master of Business Administration from the University, serves as the executive vice-president and chief financial officer for the company, while McAllister, who completed the Executive Program from the Queen’s School of Business, has served as president since his appointment in September 2019.

Syncrude

Donations: < $100,000

Research contributions: $40,000

The company is one of the largest oil sands producers in Alberta. With a cumulative production of oil exceeding 2.8 billion barrels, they are also the single largest source producer of crude oil in Canada.The company currently has a $40,000 research contract with the university based on information technology. Headquartered in Fort McMurray, Alberta, Syncrude has the capacity to produce 15 percent of Canada’s crude oil consumption. In 2005, the company was ranked as having the seventh highest air releases of combined air polluting gases in Canada. In 2012, the company’s Mildred Lake plant location was found to be the highest emitter of greenhouse gases in the country, emitting more than 12 million tonnes of CO2 equivalent gases. Syncrude plans on expanding their Mildred Lake location to further the company’s crude oil mining and processing capabilities. This project, called the Mildred Lake Expansion Project, is expected to begin in 2023.

—with files from Iain Sherriff-Scott

Tags

climate crisis, Fossil fuel divestment

All final editorial decisions are made by the Editor(s)-in-Chief and/or the Managing Editor. Authors should not be contacted, targeted, or harassed under any circumstances. If you have any grievances with this article, please direct your comments to journal_editors@ams.queensu.ca.